At nearly a quarter of global wheat exports, Russia tops grain exporters worldwide

ALBAWABA – Only a dozen countries are producing enough grains to export, Agence France-Presse (AFP) reported Tuesday, as Russia tops grain exporters worldwide as of September 2023.

The International Grain Council (IGC) expects global wheat production to drop 2.4 percent in the 2023-2024 season, at 784 million tonnes.

Notably, the IGC brings together major wheat-producing and importing nations. But today, only 12 countries in the world produce enough wheat to export, including major and minor producers.

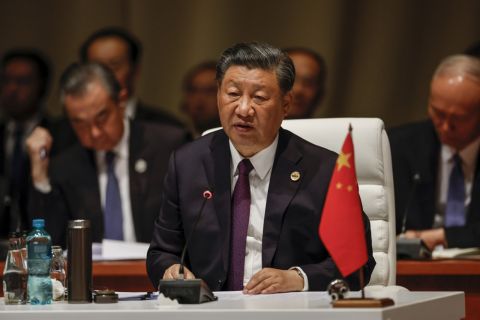

In terms of production, China is by far the world’s largest producer, producing 138 million tonnes in 2022-2023. But it only imports a little over 10 million tonnes per year, as it allocates the bulk of its grain produce to feed its population of 1.4 billion and maintaining a large reserve.

India is another large wheat producer but the country only recently began to export surplus grains, up until last year, when the government imposed restrictions on exports after a devastating drought.

Russia, the United States, Australia and France are the other major producers.

Canada, Australia and US trail behind as Russia tops grain exporters worldwide

After a record harvest of 92 to 100 million tonnes in 2022-2023, Russia is heading for its second-best harvest ever at around 90 million tonnes, according to Sebastien Poncelet, a specialist at Agritel.

Russia was the top exporter in 2022-2023 at 46 million tonnes, according to the US Department of Agriculture (USDA), as reported by AFP, and could account for a quarter of the global wheat trade this year.

Farmers harvest wheat in the southern Russian Rostov region, some 1,5 km off the border with the self-proclaimed Donetsk People's Republic (DNR) in eastern Ukraine, on July 7, 2022. (Photo by STRINGER / AFP)

Trailing behind are Canada, Australia and the United States (US), whose exports are expected to fall under 20 million tonnes to their lowest level in half a century. Following are France and Ukraine, one the third-largest exporter before the war with Russia broke out. Ukraine is set to export 10 million tonnes, according to the USDA.

Turkey has been the biggest buyer of Russian wheat since 2018, followed by Egypt, as they accounted for 40 percent of Russian wheat exporters, AFP reported, along with Iran and Syria.

Recently, however, Russia’s export market base is expanding as Russian wheat is finding more and more buyers, including in western Europe, northern Africa and sub-Saharan Africa, the news agency reported.

Total Africa trade with Russia totalled $14 billion in 2020, compared to $65 billion with the US, $254 with China and $295 with the European Union, according to the African Institute for Security Studies.

Wheat is not a staple in most of Africa. But it is an important source of calories in many countries, particularly in urban centres, where bread shortages can quickly spark riots, destabilizing the situation.

These volumes, while not enormous, are not insignificant.

At 3.9 million tonnes in 2022-2023, Russian wheat accounted for around 20 percent of wheat imported into sub-Saharan Africa, but that was a drop from 4.5 million tonnes in 2021-2022.

Russia has promised to step up low-cost exports to Africa. Yet, this hasn't compensated for the drop in Ukrainian exports, which fell by more than half to 701,000 tonnes in 2022-2023, according to a study by the International Food Policy Research Institute.

Ukrainian grain exports hit insurance obstacle as Russia tops grain exporters worldwide

Meanwhile, insurance premiums have spiralled five to 10 times the amounts charged before Russia's invasion of Ukraine in February 2022. Especially since Moscow exited the Black Sea grain deal in July.

Cargo ships sail through a temporary corridor after leaving the southern Ukranian port of Odesa on September 1, 2023. (Photo by STRINGER / AFP)

The Black Sea Grain Initiative allowed Ukraine to export 33 million tonnes of grain, and helped push down global food prices, according to AFP.

As of July this year, the majority of previously shipped Ukrainian grain exports now travel via the Danube river and by rail. But ports along the river are also under attack from Russians, according to Frederic Denefle, head of Garex, a French company specialised in marine risk insurance.

More so, Ukraine announced the establishment of a new Black Sea corridor, without Russia’s blessing. Four ships have gone along the new sea route, while Russia is preparing a plan to send foodstuffs for free to some African countries and to send discounted grain for processing in Turkey.

One ship, so far, has made it out of the Black Sea using the new route, arriving in Turkey in mid-August, according to AFP; the container ship Joseph Schulte.